AgentHack submission type

Enterprise Agents

Name

Gagandeep Singh

How many agents do you use

Multiple agents

Industry category in which use case would best fit in (Select up to 2 industries)

Banking and financial services

Complexity level

Intermediate

Summary (abstract)

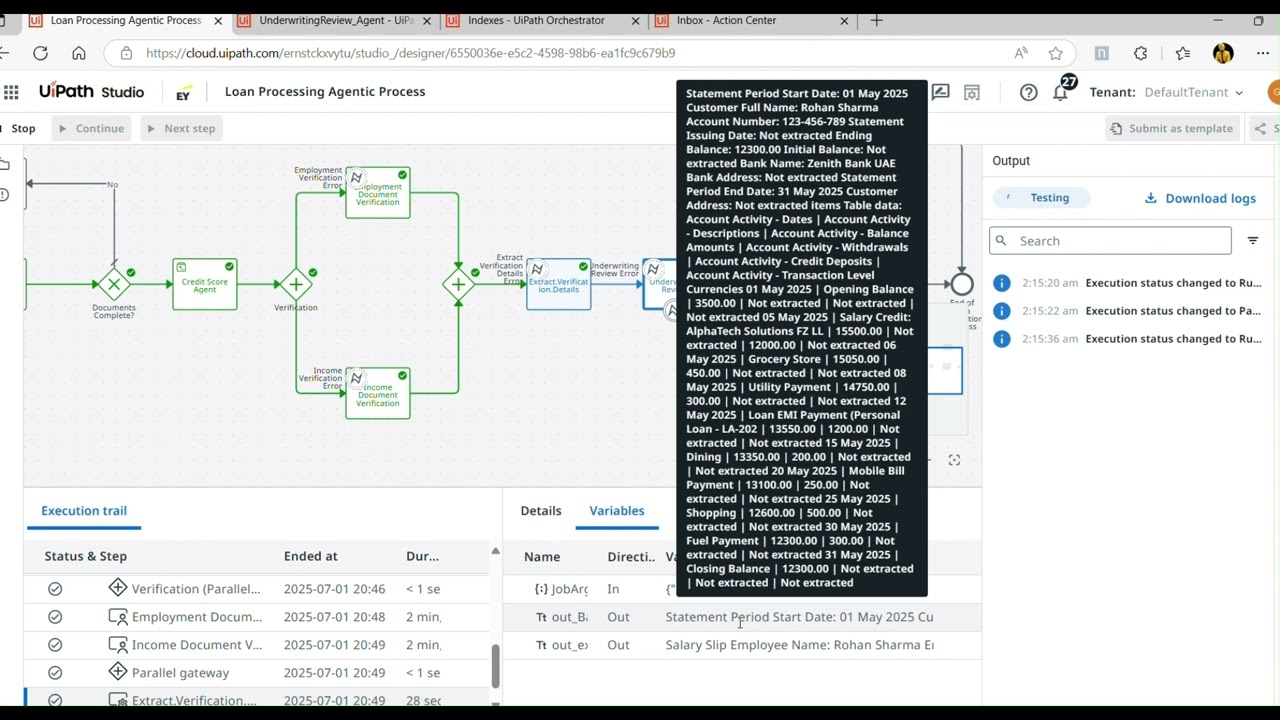

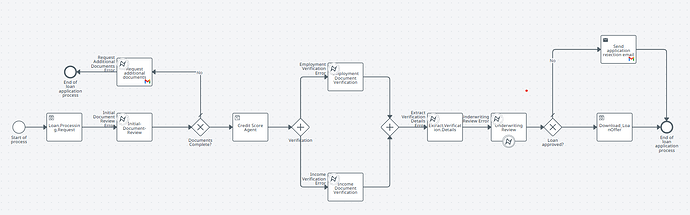

The Loan Agentic Process is a smart, end-to-end automation flow designed using UiPath Agents, Maestro, Document Understanding, and GenAI, enabling autonomous and collaborative decision-making for loan processing.

Detailed problem statement

Traditional loan processing systems are heavily manual, slow, and error-prone due to:

![]() Unstructured intake of applications via emails and documents (PDFs, Word)

Unstructured intake of applications via emails and documents (PDFs, Word)

![]() Inconsistent document formats that require human review

Inconsistent document formats that require human review

![]() Manual interpretation of applicant intent and loan types

Manual interpretation of applicant intent and loan types

![]() Time-consuming validation of financial details and eligibility checks

Time-consuming validation of financial details and eligibility checks

![]() Limited visibility and delays when involving business users for clarifications

Limited visibility and delays when involving business users for clarifications

![]() Disconnected systems (email, APIs, humans, bots) causing bottlenecks

Disconnected systems (email, APIs, humans, bots) causing bottlenecks

The challenge is to streamline and scale loan application processing by:

Reducing human dependency

Automating understanding of documents

Making intelligent decisions

Integrating all stakeholders (bots, agents, humans) in one seamless flow

Detailed solution

Key Components & Flow:

Email Intake & Intent Recognition

Incoming loan applications (PDFs/Docs) received via Gmail

GenAI analyzes email content to detect intent (e.g., Loan Request, Follow-up)

Document Understanding (DU)

Automatically reads and extracts key data from semi/unstructured attachments

Handles multiple formats like PDFs, Word files, etc.

AI Agent Reasoning

Context-aware decision-making engine built using UiPath AI Agents

Validates input data, checks completeness, and routes accordingly

External API Integrations

Calls credit bureau or salary verification APIs for background checks

Fetches real-time financial info for scoring

Human-in-the-Loop (HITL)

If data is incomplete or flagged, an Action Center task is triggered

Business users review/edit missing or inconsistent details via UI Apps

Decision & Communication

Agent calculates loan eligibility & risk score

Generates personalized approval/rejection response

Sends final email with outcome and next steps

![]() Why Agentic?

Why Agentic?

Combines autonomous AI reasoning with structured workflow

Ensures compliance, accuracy, and business oversight

Enables faster decisions, minimal manual intervention, and scalable operations

Demo Video

Expected impact of this automation

Implementing the Agentic Process for loan applications is expected to deliver significant business and operational benefits:

![]() Efficiency & Speed

Efficiency & Speed

Up to 60–70% reduction in loan processing time

Instant extraction of data from emails & documents using DU + GenAI

Faster decisions with AI agents handling initial triage and validation

![]() Accuracy & Compliance

Accuracy & Compliance

Improved data accuracy through AI-driven validations

Reduced manual entry errors and compliance risks

Enforced standardized decision-making logic across processes

![]() Enhanced User Experience

Enhanced User Experience

Business users looped in only when needed via Action Center

Clear, automated communication to applicants

Reduced turnaround times lead to higher customer satisfactio

UiPath products used (select up to 4 items)

UiPath Agent Builder

UiPath Apps

UiPath Autopilot™

UiPath Document Understanding™

UiPath Integration Service

UiPath Maestro

UiPath Robots

UiPath Studio

Integration with external technologies

PDF Monkey

Agentic solution architecture (file size up to 4 MB)

Sample inputs and outputs for solution execution

Input : Email Request, Payslips(Word), Bank statements(pdf)

Output : Mail(Pdf Attachments)